Stability of Naira coming sooner than you expect since Naira has been under valued for too long – Abayomi Odunowo

The Foreign Exchange (FX) backlog in Nigeria has been a significant issue for the country, with $7 billion in unpaid obligations accumulating over time. This backlog has had serious implications for the country’s economy and it was evident that action needed to be taken to address the situation. In an effort to gain a better understanding of the FX backlog, Deloitte was contracted to conduct a forensic audit to determine the validity of these obligations. The results of the audit were shocking, revealing a number of concerning issues that needed to be addressed.

One of the primary findings of the forensic audit was that $2.4 billion of the obligations had issues, including not having valid import documents, allocations being given to entities that did not exist, entities receiving more FX than they had requested, and allocations being made to entities that had not requested FX at all. These discrepancies raised serious concerns about the integrity of the FX allocation process and the potential for abuse and mismanagement of funds.

In response to these findings, the Central Bank of Nigeria (CBN) took action by writing to the authorized dealers involved in the FX allocations to explain the discrepancies. Unfortunately, many of these issues were not disputed, further underscoring the need for a thorough and comprehensive review of the FX backlog.

Despite the challenges presented by the audit results, significant progress has been made in addressing the FX backlog. The CBN has successfully cleared $2.3 billion of the validly executed obligations, including those involving airlines. However, there remains a significant amount of outstanding obligations totaling $2.2 billion that still need to be addressed. It is clear that there is still much work to be done to resolve the remaining backlog, but the CBN remains confident that it will be able to address these outstanding obligations in due course.

In addition to addressing the FX backlog, the CBN also recognizes the importance of stabilizing the value of the Nigerian Naira. The undervaluation of the Naira has been a longstanding issue, and it is crucial for the country’s economic stability that measures are taken to address this. The CBN is committed to taking the necessary steps to ensure that the Naira is appropriately valued, and will continue to monitor and manage the foreign exchange market to achieve this goal.

In conclusion, the FX backlog in Nigeria has been a significant challenge for the country, but progress has been made in addressing this issue. The findings of the forensic audit highlighted serious discrepancies and issues that needed to be resolved, and the CBN has taken decisive action to address these concerns. While there is still work to be done to clear the remaining backlog and stabilize the value of the Naira, the CBN remains determined and confident in its ability to address these challenges. The progress made in addressing the FX backlog demonstrates the commitment of the CBN to ensuring the integrity of the foreign exchange market and the long-term stability of the Nigerian economy.

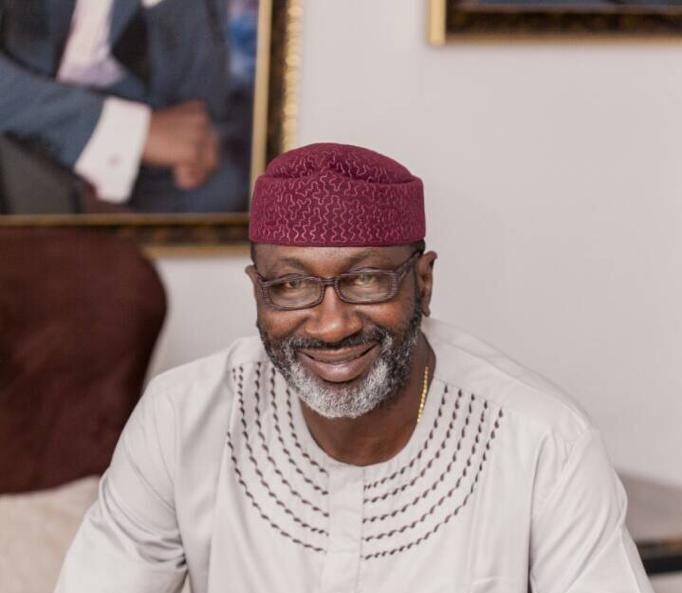

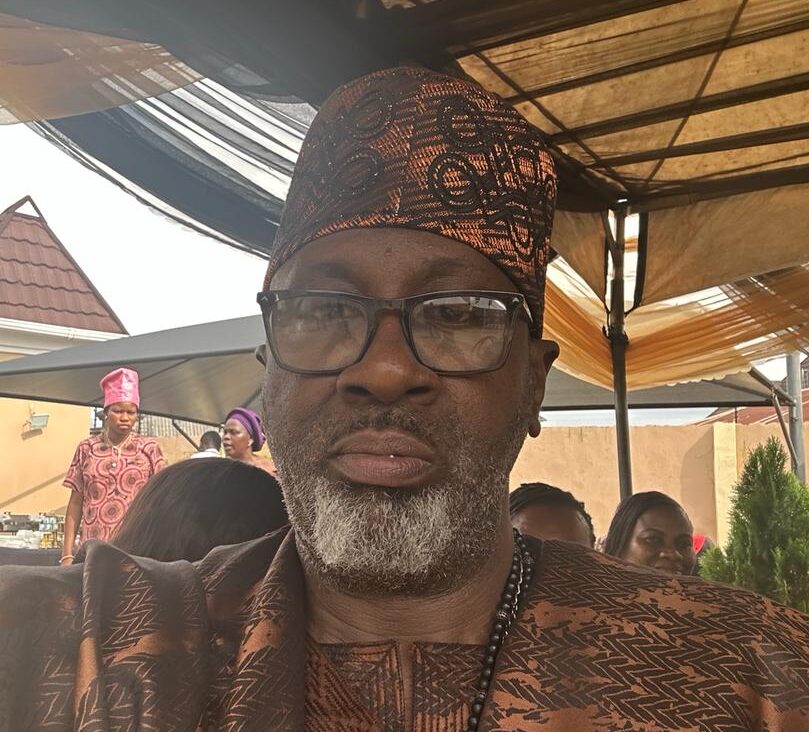

Otunba Abdulfalil Abayomi Odunowo

National Chairman AATSG

15th February, 2024.